Advertisement

-

Published Date

October 18, 2019This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

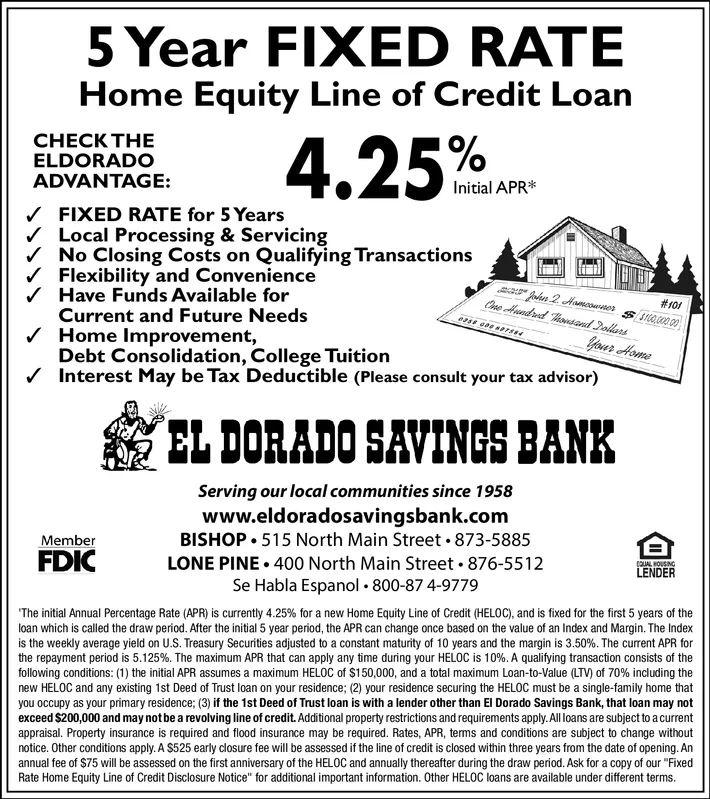

5 Year FIXED RATE Home Equity Line of Credit Loan CECK THE ELDORADO ADVANTAGE: 4.25% Initial APR FIXED RATE for 5 Years Local Processing & Servicing No Closing Costs on Qualifying Transactions Flexibility and Convenience Have Funds Available for Current and Future Needs Home Improvement, Debt Consolidation, College Tuition Interest May be Tax Deductible (Please consult your tax advisor) 2Aamcowner Ce undd hntand ollars #101 ease eas ersse Your Home EL DORADO SAVINGS BANK Serving our local communities since 1958 www.eldoradosavingsbank.com BISHOP 515 North Main Street 873-5885 Member FDIC LONE PINE 400 North Main Street 876-5512 QUAL HOUSING LENDER Se Habla Espanol 800-87 4-9779 The initial Annual Percentage Rate (APR) is currently 4.25% for a new Home Equity Line of Credit (HELOC), and is fixed for the first 5 years of the loan which is called the draw period. After the initial 5 year period, the APR can change once based on the value of an Index and Margin. The Index is the weekly average yield on U.S. Treasury Securities adjusted to a constant maturity of 10 years and the margin is 3.50%. The current APR for the repayment period is 5.125%. The maximum APR that can apply any time during your HELOC is 10 %. A qualifying transaction consists of the following conditions: (1) the initial APR assumes a maximum HELOC of $150,000, and a total maximum Loan-to-Value (LTV) of 70 % including the new HELOC and any existing 1st Deed of Trust loan on your residence; (2) your residence securing the HELOC must be a single-family home that you occupy as your primary residence; (3) if the 1st Deed of Trust loan is with a lender other than El Dorado Savings Bank, that loan may not exceed $200,000 and may not be a revolving line of credit. Additional property restrictions and requirements apply.All loans are subject to a current appraisal. Property insurance is required and flood insurance may be required. Rates, APR, terms and conditions are subject to change without notice. Other conditions apply. A $525 early closure fee will be assessed if the line of credit is closed within three years from the date of opening. An annual fee of $75 will be assessed on the first anniversary of the HELOC and annually thereafter during the draw period. Ask for a copy of our "Fixed Rate Home Equity Line of Credit Disclosure Notice" for additional important information. Other HELOC loans are available under different terms. 5 Year FIXED RATE Home Equity Line of Credit Loan CECK THE ELDORADO ADVANTAGE: 4.25% Initial APR FIXED RATE for 5 Years Local Processing & Servicing No Closing Costs on Qualifying Transactions Flexibility and Convenience Have Funds Available for Current and Future Needs Home Improvement, Debt Consolidation, College Tuition Interest May be Tax Deductible (Please consult your tax advisor) 2Aamcowner Ce undd hntand ollars #101 ease eas ersse Your Home EL DORADO SAVINGS BANK Serving our local communities since 1958 www.eldoradosavingsbank.com BISHOP 515 North Main Street 873-5885 Member FDIC LONE PINE 400 North Main Street 876-5512 QUAL HOUSING LENDER Se Habla Espanol 800-87 4-9779 The initial Annual Percentage Rate (APR) is currently 4.25% for a new Home Equity Line of Credit (HELOC), and is fixed for the first 5 years of the loan which is called the draw period. After the initial 5 year period, the APR can change once based on the value of an Index and Margin. The Index is the weekly average yield on U.S. Treasury Securities adjusted to a constant maturity of 10 years and the margin is 3.50%. The current APR for the repayment period is 5.125%. The maximum APR that can apply any time during your HELOC is 10 %. A qualifying transaction consists of the following conditions: (1) the initial APR assumes a maximum HELOC of $150,000, and a total maximum Loan-to-Value (LTV) of 70 % including the new HELOC and any existing 1st Deed of Trust loan on your residence; (2) your residence securing the HELOC must be a single-family home that you occupy as your primary residence; (3) if the 1st Deed of Trust loan is with a lender other than El Dorado Savings Bank, that loan may not exceed $200,000 and may not be a revolving line of credit. Additional property restrictions and requirements apply.All loans are subject to a current appraisal. Property insurance is required and flood insurance may be required. Rates, APR, terms and conditions are subject to change without notice. Other conditions apply. A $525 early closure fee will be assessed if the line of credit is closed within three years from the date of opening. An annual fee of $75 will be assessed on the first anniversary of the HELOC and annually thereafter during the draw period. Ask for a copy of our "Fixed Rate Home Equity Line of Credit Disclosure Notice" for additional important information. Other HELOC loans are available under different terms.